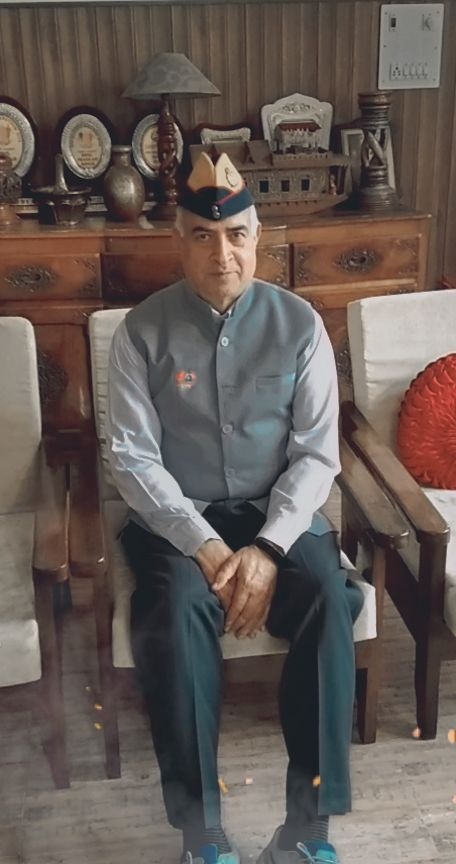

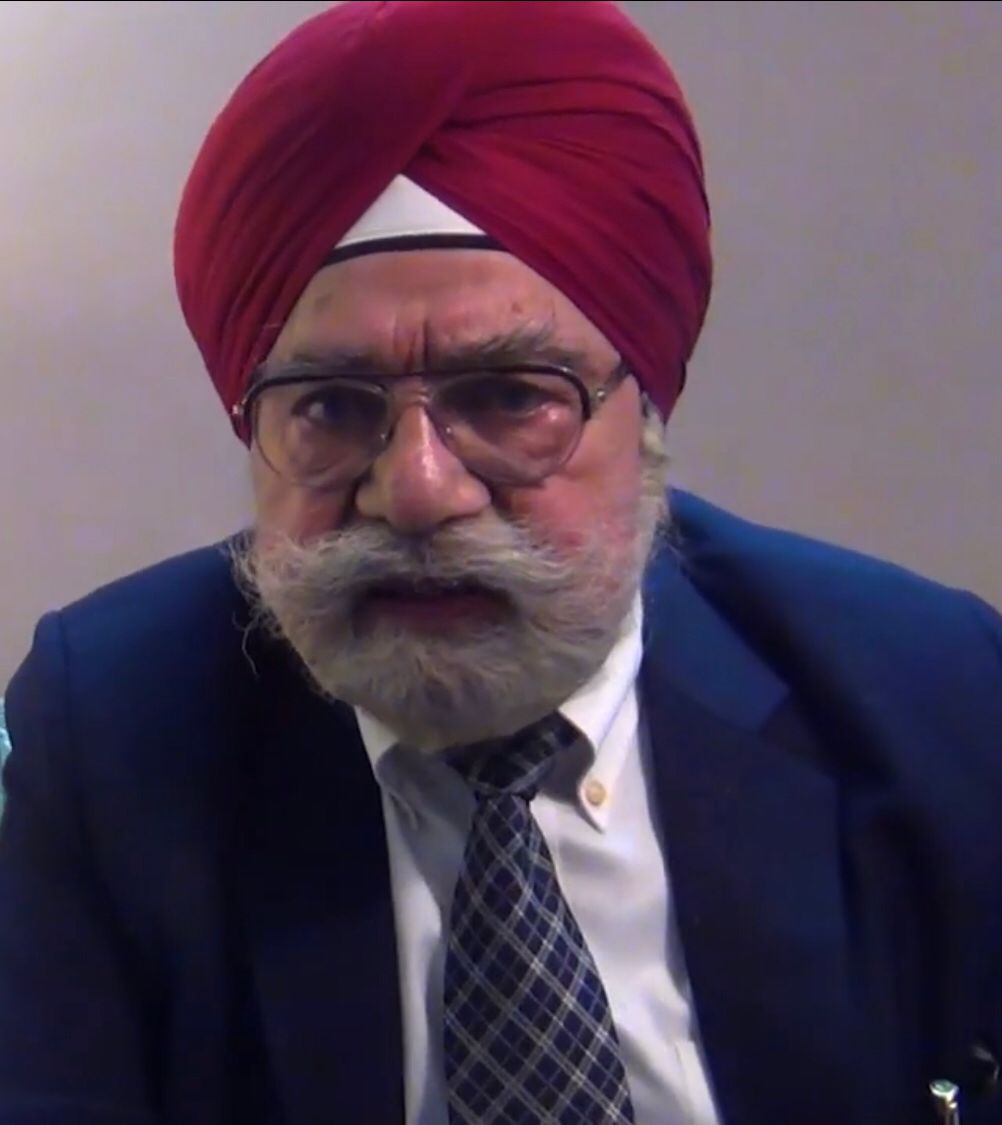

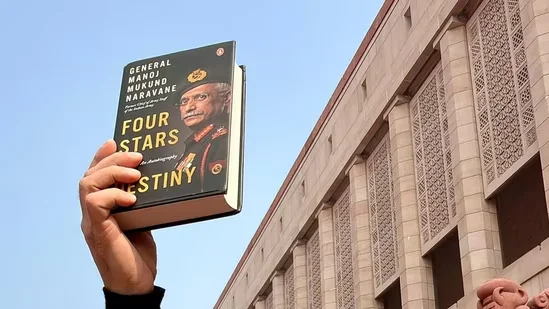

A book by General MM Naravane, India’s former Chief of Army Staff (COAS), has dominated Parliament proceedings this week, with Leader of Opposition Rahul Gandhi being stopped from citing its contents to question PM Narendra Modi and his government over their China policy. It’s not published, so can’t be cited, according to Rajnath Singh, who heads the defence ministry where it’s reportedly pending for approval since 2023.

He has also shared how he decided to write it at all. “There is a story behind writing this book. I had no intention of writing a memoir or an autobiography,” he told web channel Lallantop in an interview in April 2025, a year after the book was originally supposed to be published.

“Penguin (publishing house) had published a book on the late General Bipin Rawat. I went to its book release in March 2023. People who had come from Penguin, jokingly I told them that ‘you aren’t publishing a book of mine’. In response, they asked, ‘Have you written a book?’ I said no,” he recalled.

“I told them, ‘If you say so, I will write it,’ to which they said, ‘Yes sir, it will be a matter of pride if you give us this opportunity to publish your book’,” the retired officer said. “And like that, by the way, this process started for me to write a book.” He said the satisfaction he has got by writing the book “is enough”.

Moments of national security crisis do not always collapse because of poor intelligence or

weak soldiers. Sometimes, they fail because no one at the top is willing to own the decision

that history demands. General Manoj Mukund Naravane’s account of the tense night on the

Kailash Range in eastern Ladakh offers a stark illustration of this failure—one where political

leadership chose ambiguity over accountability.

As Chinese tanks advanced to within a few hundred metres of Indian positions, local

commanders did what professional soldiers are trained to do: report, warn, and seek orders.

An illuminating round was fired—a warning, not an act of escalation. It failed. The Chinese

kept moving. The situation had crossed from routine friction into imminent confrontation.

At that point, the Chief of Army Staff did exactly what civil–military doctrine requires.

Naravane reached out to the apex of India’s political and strategic leadership: Rajnath

Singh, Ajit Doval, Bipin Rawat, and S Jaishankar. His question was simple, direct, and

unavoidable: What are my orders?

The answer, devastatingly, was silence.

The Cost of Not Deciding

India had imposed extraordinary restrictions on the use of force—orders not to open fire

without clearance “from the very top.” Such political control over escalation is

understandable in theory. Nuclear-armed neighbours, fragile diplomacy, and international

optics demand caution.

But caution is not the same as paralysis.

By withholding a clear directive at a moment when tanks were rolling forward and minutes

mattered, political leadership effectively outsourced the risk downward—without authorising

the authority needed to manage it. This is not civilian supremacy. It is civilian abdication.

In crisis management, not giving an order is itself an order. It tells commanders: absorb the

risk, take the blame if things go wrong, and preserve political deniability at all costs.

Plausible Deniability as Strategy

Naravane’s account exposes a deeper pattern: the preference of political leadership to

maintain strategic ambiguity not toward the adversary, but toward its own military.

If firing is prohibited without top clearance, then the top must be prepared to give—or

explicitly refuse—that clearance in real time. Otherwise, the system becomes structurally

dishonest. Publicly, leaders project resolve. Privately, they avoid decision points that could

later demand explanation in Parliament, the media, or history.

This culture explains much of what followed Galwan: opaque disengagement terms,

euphemisms like “buffer zones” and “friction points,” and the quiet normalization of territory

where Indian patrols no longer patrol. Political leadership could claim peace while the

military absorbed the strategic loss.

Ownership would have required standing up and saying one of two things:

The Indian Army’s High Altitude Warfare School (HAWS) in Gulmarg conducted an intensive two-week training course in extreme high altitude terrain and harsh weather conditions that was tailor-made for members of the Kyrgyzstan Armed Forces. Photo: ADGPI

The Indian Army’s High Altitude Warfare School (HAWS) in Gulmarg conducted an intensive two-week training course in extreme high altitude terrain and harsh weather conditions that was tailor-made for members of the Kyrgyzstan Armed Forces.

The training curriculum focused on military skiing, casualty evacuation, avalanche rescue and recovery drills and the management of high-altitude sickness, according to information shared by the Indian Army.

“The course also enabled a vibrant exchange of best practices between both nations in high-altitude medicine, casualty evacuation and military skiing techniques, further strengthening mutual understanding and reinforcing the spirit of ‘Friends for Life’,” the Army said.

Established in 1948, HAWS specialises in snow-craft and winter warfare. Two major programmes run by the school are Mountain Warfare Course and Winter Warfare Course, which train soldiers in high altitude warfare, counter intelligence and survival skills. Army personnel deployed to Siachen Glacier and to other high altitude forward posts in the Himalayas go through the courses. Soldiers from several friendly foreign countries, including the US, UK and Germany attend these courses.

India and Kazakhstan relations date back to 1992 in the aftermath of the collapse of the Soviet Union and have been elevated to the strategic level based on robust economic ties, mutual trust, energy cooperation and shared security interests. In August 2025, India and Kazakhstan held discussions in New Delhi to enhance their defence cooperation.

Besides cooperation in the field of counter terrorism and cyber security, both countries have also undertaken joint military exercises that was initially named Prabal Dostyk and later rechristened Exercise KAZIND. It focuses on counter-terrorism operations, joint planning, joint tactical drills, specialised weapons training, and more recently an aerial component involving helicopter-borne operations.

Training of military personnel at HAWS assumes significance for Kazakhstan because of its climate and geography. Temperatures in that country can dip to minus 20 degrees Celsius, while mountain peaks located in some parts of the country touch 23,000 ft.

As a newly raised Bhairav battalion marched down Kartavya Path on Republic Day this year, it marked the Indian Army’s evolving strategy and doctrinal approach to meet the challenges faced in the contemporary multi-domain battle space.

In a few months, the raising of all the 25 planned battalions is expected to be complete, giving field commanders a powerful tool for high-intensity border operations.

Conceived in 2025, Bhairav battalions are light commando units comprising about 300 troops, primarily from the infantry with embedded elements from support arms, to bridge the gap between the traditional line infantry and the Special Forces.

Specializing in targeted disruption missions, drone operations, surveillance and swift independent actions, these compact, technology intensive and highly mobile units would come under the ambit of Corps and Division Commanders.

These are structured, trained and equipped designed for reconnaissance, rapid-response and hybrid warfare that involves simultaneous operations in multiple domains. Each such battalion also has a dedicated platoon, called Ashni, for drone and loiter munitions operations. Cyber warfare and information warfare are other specialities of these battalions

The SF are trained and oriented on deep-strike and high-risk missions behind enemy lines, while Bhairav units would be engaged in localised tactical operations, rapid border responses, providing field commanders a sword arm at the sharp-end without involving the Special Forces (SF) which are meant for strategic and high stake missions.

Bhairav battalions would be at the disposal of field commanders at the level of Corps and Divisions for employment within their respective areas or responsibility, whereas the missions and deployment of SF are worked out at the level of Command and Army Headquarters to cater to the larger strategic environment at the national level.

The Army has 15 regular SF battalions, a Rashtriya Rifles battalion and two Territorial Army battalions, some of which are deployed in a counter-terrorist environment. An SF battalion consists of about 650 personnel, whereas a regular infantry battalion, of which there are over 400, has 800 troops.

Army officers said that the raising of Bhairav battalions is part of a broader infantry modernisation drive towards proactive, technology-integrated warfare. The concept has been validated during exercises like Akhand Prahar, but this is still an evolving process that may require doctrinal changes and structural realignments to fine tune this idea and meet emerging operational requirements.

In October 2025, Lt Gen Ajay Kumar, the Director General, Infantry, had said that five Bhairav battalions were fully functional and deployed, with four more nearing deployment.

In January 2026, reports said that 15 Bhairav battalions were functional and the remaining 10 or so units would become fully functional in the coming months.

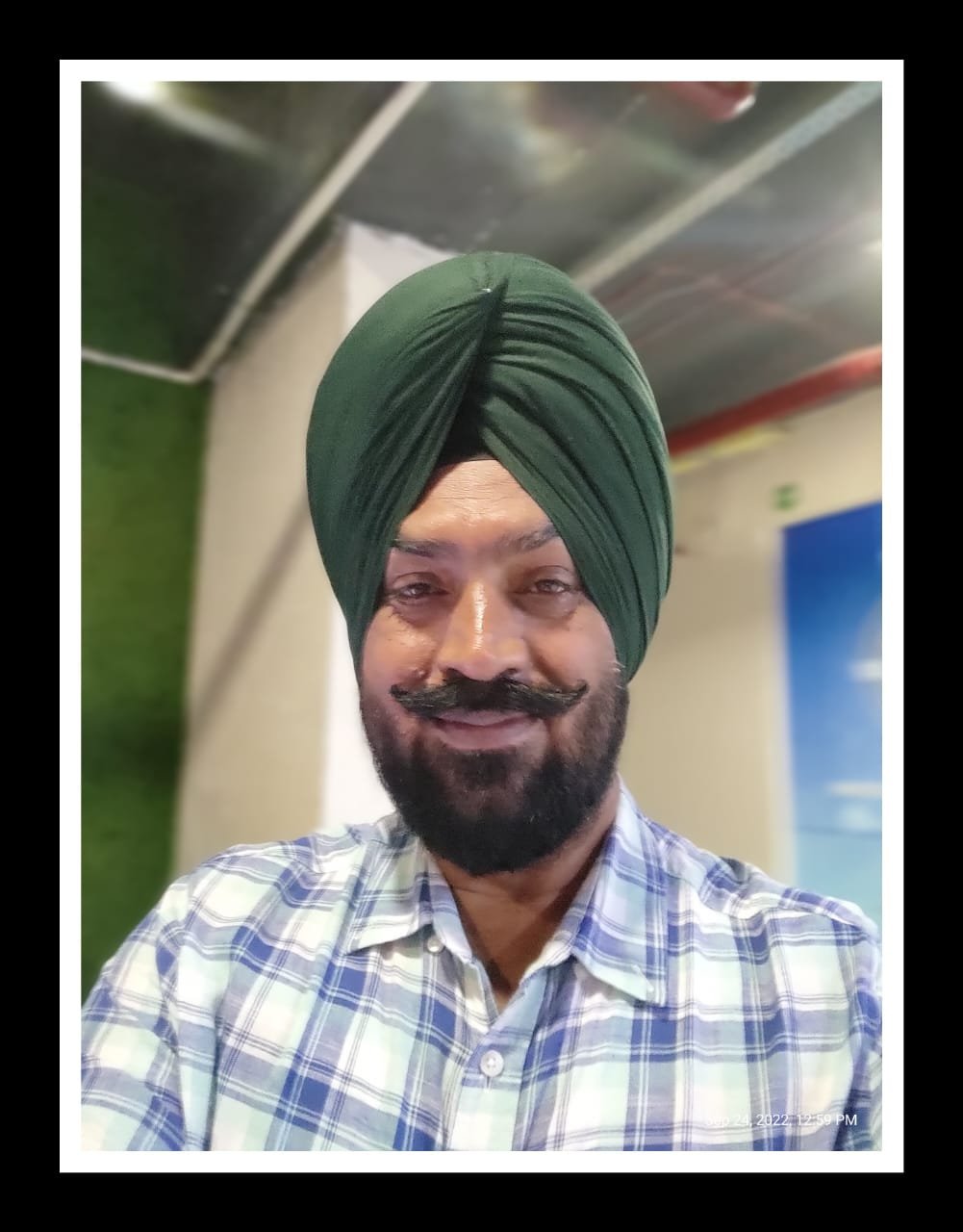

The Fourth Bhairav Battalion that took part in the Republic Day parade in the Capital was affiliated to the Sikh Light Infantry, which draws its manpower from the Mazhabi and Ramdasia Sikh communities.

The regiment in its present form was raised in 1941, though some of its constituent units trace their origins to 1857 as part of the Royal Sikh Pioneers of the British Indian Army.

The Sixth Bhairav Battalion that took part in a public event in Kolkata, for instance, is composed of troops from the north-east. A video on social media showed them singing the regimental song of the Assam Regiment.

Similarly, the Second Bhairav Battalion that took part in the Army Day Parade in Jaipur in January, is reported to be affiliated with the Rajputana Rifles that comprises Rajputs and Jats.

Soldiers in the Bhairav battalions do not wear the title of their parent regiment on their epaulettes. Shoulder titles on their uniforms mention ‘Bhairav’ and a sleeve patch identifies the battalion.

In Hindu mythology, ‘Bhairav’ is a fierce, powerful manifestation of the god Shiv, known as the destroyer of fear, time and evil. Bhairav, implying “fearsome”, is worshipped in India, Nepal, Indonesia, Sri Lanka, Japan as well as in Tibetan Buddhism.

According to sources, most Infantry Regiments would have a Bhairav battalion as part of their overall force accretion. Troops for the Bhairav battalion would be drawn from different battalions of the regiment and each Bhairav battalion would reflect the class composition of the parent regiment.

The Infantry comprises 26 Regiments including the seven different Gorkha Rifles. These regiments recruit soldiers on the basis of caste, community or geographical areas, making a homogeneous demographic and cultural profile.

The exception to this was the Brigade of the Guards that was raised post-Independence and recruited soldiers on an all-India basis, but this has been fully mechanised and is no longer considered as the Infantry.

Public sector military plane manufacturer Hindustan Aeronautics Limited (HAL) on Thursday said it is ready with five “fully ready” Tejas Mark 1-A fighter jets for the Indian Air Force (IAF).

Another nine jets are ready at the factory and they await engines from US firm General Electric (GE), the HAL said.

“We can confirm that five aircraft are fully ready for delivery, incorporating major contracted capabilities in accordance with the agreed specifications. An additional nine aircraft have already been built. Upon receipt of engines from GE, these planes will be made ready for delivery,” the Bengaluru-headquartered company said.

All design and development issues identified were being addressed in an expedited manner, it said. The HAL is in active discussions with the Indian Air Force to deliver the aircraft at the earliest, the company said, adding “it will meet the guidance (timeline) projected for the current financial year”.

The HAL said it had received five engines from GE as on date. “The supply position from GE is positive and the future delivery outlook aligns with the HAL’s delivery plans,” it added.

Sources said the delay in supply of F404 engines has set back the delivery schedule of the Tejas Mark 1-A jets. HAL is producing 180 of these planes for the Indian Air Force. The deliveries of the planes were to start in March 2024, and the engines should have come before that date.

The delay in supplies of contracted equipment of the GE F404 engines needed for the under-production Tejas Mark1-A fighter jets has become irksome for India. In July last year, Defence Minister Rajnath Singh asked his US counterpart Pete Hegseth to fast-track the delivery.

New Delhi is commercially committed to US-origin supplies of engines needed for fighter jets. Since the US-India relations soured last year, the supplies of engines have been delayed.

With the four-year term of the first batch of Agniveers scheduled to be over by the end of this year, the Punjab Government has started the ground work for the post-release rehabilitation of soldiers belonging to the state.

“We have had a few rounds of discussions at the secretary level for formulating various rehabilitation schemes and fixing reservations in some state government departments, but formal proposals in this regard for consideration at the apex level are yet to be formulated,” a senior state government officer said.

Among the possibilities being discussed are reservations for Agniveers in the Punjab Police and earmarking some posts in other departments such as civil defence, fire services, mining, pollution control and forests. Also being mulled are schemes, assistance and incentives to empower Agniveers for suitable employment in the industry or starting their own ventures.

Speaking at Defence Skills Conclave organised by the Punjab Government in Chandigarh recently, the Defence Secretary, Rajesh Kumar Singh had said that Punjab, with its strong military tradition can take the lead in tapping the skills of Agniveers by offering them institutional pathways to transition into the defence manufacturing ecosystem as supervisors, equipment maintainers or entrepreneurs.

He had said that the Agniveer scheme provides an opportunity of harnessing a skilled manpower which is already disciplined and trained through a skilled certification framework to ensure that their certified training leads into civilian qualifications recognised under National Skills Qualification Framework, which can seamlessly turn towards our defence industry.

Approved in 2022, the Agniveer scheme entails recruitment to the rank and file for a four-year period, including basic training, out of which 25 per cent would be absorbed into the permanent cadre and the rest would be released from service. The Indian Air Force (IAF) initiated training of the first batch in December 30, 2022, followed by the Indian Army and Navy in January 2023.

Punjab Government officials said that some states, including neighbouring Haryana, have already announced schemes for the rehabilitation of Agniveers. Different Central Government ministries have also created a quota for Agniveers in the Central Armed Police Forces and other establishments, besides introducing skill development programmes and enabling qualification certification. Given that less than a year is left for the release of the first batch, Punjab already has a 13 per cent reservation for ex-servicemen in some departments, but this was meant for the regular soldiers who were released on completion of their colour service after serving for at least 15 years. Sources said that many of this quota also remains unfilled by ex-servicemen due to various eligibility and administrative issues.

Punjab is the second largest contributor of manpower to the Armed Forces after Uttar Pradesh, and in fact, recruitment from the state is more than its prescribed quota, sources said. Vacancies allotted to other states that remain unutilised are filled by candidates from Punjab.

The pension outlay for armed forces personnel, which forms a significant chunk of the annual defence budget, has seen a marginal increase of 1.27 per cent for the 2026-27 financial year over the current fiscal.

In her Budget, Finance Minister Nirmala Sitharaman has proposed an allocation of Rs 1,71,338.22 crore for pensions and other retirement benefits for the three services. The revised estimate for the 2025-26 fiscal was Rs 1,69,186.50 crore, whereas the actual expenditure for the 2024-25 fiscal was Rs 1,57,653.65 crore, according to data in the budget documents.

According to government data shared with Parliament in 2025, there are about 28 lakh registered ex-servicemen in the country. The figure includes about 24 lakh from the Army, 2.26 lakh from the Air Force and 1.5 lakh from the Navy. In addition, there are pensioners residing in Nepal who have served in the Indian armed forces.

Uttar Pradesh has the highest number of ex-servicemen among all states and union territories in the country, followed by Punjab and Rajasthan. Other states having a relatively higher population of ex-servicemen are Maharashtra, Kerala, Haryana, Himachal Pradesh, Bihar, Uttarakhand and Tamil Nadu.

The allocation for the Ex-servicemen Contributory Heath Scheme (ECHS), which has in the past come under fire for inadequate budgetary support, has also been enhanced. With a clientele base of 55 lakh beneficiaries, the scheme provides cashless medical cover facilities to ex-servicemen and their dependants through a network of 450 polyclinics and about 2,700 empanelled hospitals, diagnostic facilities and clinical laboratories.The ECHS revenue expenditure for 2026-27 has been proposed at Rs 12,100 crore compared to the revised estimates of Rs 11,000 crore for 2025-26 and the actual expenditure of Rs 10,914.78 crore for 2024-25. The capital expenditure for 2026-27 has been proposed at Rs 60 crore against the revised estimate of Rs 50 crore for 2025-26 and the actual expenditure of Rs 14.42 crore for 2024-25.

The capital expenditure is meant for creating assets like buildings and equipment for the long term while the revenue expenditure covers daily operating costs like salaries, utilities and miscellaneous expenditure.

The proposed allocations mark an increase of over six per cent over the revised estimates of Rs 1,60,961.09 crore for the 2025-26 fiscal

Pay and allowances for the armed forces make up about 47 per cent of the revenue component of the defence budget of the 2026-27 fiscal presented in the Parliament by Finance Minister Nirmala Sitharaman on Sunday.

The total outlay under this head has been proposed at Rs 1,71,043.82 crore, which includes the emoluments of regular armed forces personnel as well as auxiliary forces and civilian employees, including staff engaged in research and development in the three services.

The proposed allocations mark an increase of over six per cent over the revised estimates of Rs 1,60,961.09 crore for the 2025-26 fiscal, according to figures mentioned in the budget documents.

The revenue expenditure of the ministry is pegged at Rs 3,65,478.98 crore. This includes establishment expenditure under heads such as pay and allowances Ex-servicemen Contributory Health Scheme, works, Rashtriya Rifles, NCC, Agnipath, training, research and development, as well as other Central sector expenditure like transport, stores, spectrum charges, repairs and refit and general services.

The proposed expenditure of Rs 1,71,338.22 crore on defence pensions and retirement benefits for 2026-27 are listed separately under a different demand head. Expenditure to be incurred on several other civil establishments under the defence ministry come under a different head.

Revenue expenditure is used for carrying out day to day business and includes salaries, utilities, rent, maintenance, work travel and miscellaneous expenses, but does not involve building assets and procuring equipment for the long term, which come under the budget’s capital outlay.

For the 2026-27 fiscal, pay and allowances have been pegged at Rs 1,18,167.91 crore for the Army, Rs 20,536.83 crore for the Air Force and Rs 9,662.50 for the Navy. For the auxiliary forces, civilian employees in all three services and research and development staff, including service personnel, the combined allocation is Rs 22,676.58 crore.

India has the world’s third largest military in terms of manpower. The combined strength of armed forces personnel in India is a little over 14 lakh uniformed personnel, with the Army constituting the largest component. In addition, there are civilian employees who do not come under the purview of the Army, Navy or Air Force Acts and are engaged in administrative, support and ancillary services.