SS Chahal

AGRICULTURE is the engine of economic growth in our country. However, the annual growth rate of agriculture and allied sectors has shown big fluctuations with declining trends during the post-Green Revolution period. The growth rate in real terms was 2.88 per cent from 2014-15 to 2018-19, according to the Economic Survey Report 2020. Studies have revealed that stagnant investment is one of the major factors for the decline, besides the slowdown of irrigation expansion, downscaling of production due to farm fragmentation and soil degradation due to improper use of chemical fertilisers. An analysis of data reveals continuing deceleration in public investment both at the national and state levels after the 1980s ‘in’ agriculture (land development, irrigation, markets etc.) as well as ‘for’ agriculture (roads, power, transport etc.), because of which there is no desirable improvement in the structural support system. Public investment, which has declined over the years, is mostly consumed for subsidies, fertilisers, irrigation, electricity, credit etc., whereas private investment made by farmers is adversely impacted by heavy indebtedness.

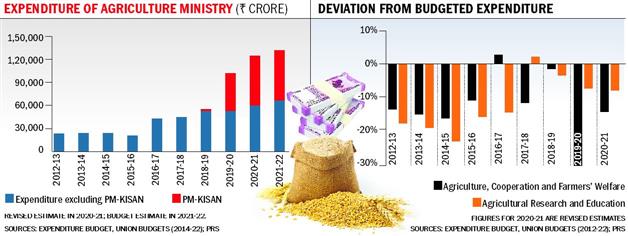

The share of public investment in the Gross Capital Formation (GCF) has dipped to an extremely low level. As per figures given by the Union government, the GCF in agriculture and allied sectors at the current prices for 2016-17 was estimated at Rs 64,410 crore and Rs 2,79,066 crore from public and private investments, respectively. Any increase in public investment is beyond expectations with the 7.71 per cent cut for agri-schemes in the Union Budget 2021-22. To put agri-growth in the rapid mode, there is an acute need to improve infrastructure, including transportation and storage facilities, cold storage capacity in proximity to farms, warehouses and adequate processing, marketing and export facilities, the lack of which is causing huge wastage and losses to the public exchequer as well as the farmers. A study in 2016 estimated that about 67 million tonnes of food worth Rs 92,651 crore was lost annually in farm produce wastage.

To build infrastructure for curbing such losses and achieving the target of 10.4 per cent income growth rate in farming over a period from 2016-17 to 2022-23 (with 2015-16 as the base year), the Ministry of Agriculture and Farmers’ Welfare aims at an annual investment growth rate of 12.5 per cent ‘in’ agriculture and 16.8 per cent ‘for’ agriculture. While expecting a substantial increase in private investment by farmers, attracting corporate investment, which is currently around 2 per cent of the overall investment, is a huge challenge. A growing need has been felt for corporate investment in food processing, building warehouses, scientific storage and cold storage in addition to the farm mechanisation sector, the seed sector and the horticulture and food processing sector. Further, it is prudent to develop models defining capability-based activities for qualitative improvement and sustainable flow of corporate investment.

Direct contact

It is with such considerations that contract farming (CF) is promoted to involve corporate agri-business entities, bringing them directly in contact with the primary producers as well as linking farmers with the market. The CF system basically involves a pre-determined price, quality, quantity and defined acreage at a time for production and commitment for the supply of agricultural produce to the known buyer under the contract which may be total, partial or for procurement only. The system got established in the country with the advent of new seeds and production of their certified versions since the 1960s. Further, it has been pushed by growth in the international trade demanding high quality, supermarket chains, demand for organic food, drying up of state funding, the agrarian crisis and support from the industry and the banking sector. Public as well as private sector banks leveraged their interest and promoted financing for CF by formulating special policies, setting up of agricultural credit, offering quick loans, reducing interest rates, increasing direct agriculture lending portfolios and tying up for end-to-end financing through tripartite agreements between farmers, banks and the industry.

Seen as an alternative to private and corporate farming, CF lowers transactional costs for both the contracting parties because many transactions become internalised. Farmers get access to new technologies and inputs and contracting agencies get assured supply of raw material. A few of the several examples of successful models include the poultry sector, the production of certified seeds of field crops and cultivation of potato, barley and sugarcane. Evidence is available for increased productivity/production, better incomes and employment through contracting, but it requires sustainability.

FPOs the best bet

The system suffers from bottlenecks because of which it has not attained popularity so far. Evaluating quality and grading of produce is a critical matter and often exploited for rejection or reducing the price by the contracting companies. An inbuilt provision of settlement by a state coordinator or arbitrator should help resolve such cases to the satisfaction of the parties. Small farmers are in an unfavourable position because of their limited ability to deal with big companies. In this context, the Thailand model to facilitate groups of small farmers for collectively entering into contracts has proved useful. However, the best course is that small farmers should enter into CF by forming New Generation Cooperatives commonly known as Farmer Producer Organisations (FPOs). That will enhance access to a variety of resources, effectively maintaining quality standards, better application of scientific farming techniques and increase in bargaining power and capacity to pursue litigation collectively. The Centre has set a target of supporting 10,000 more FPOs in the next financial year. Some problems faced by the growers include delayed deliveries at the factory, unforeseen pest attacks raising the cost of cultivation, no legal protection for often verbal and informal contracts, monopsony and lack of strict enforceability of contractual provisions. Delayed payments are of frequent occurrence.

Making payments within the stipulated time frame has been addressed in Clause 6(3) of the new law, the Farmers (Empowerment and Protection) Agreement on Prices Assurance and Farm Services Act, 2020. However, restricting dispute settlement rights up to the district-level bureaucratic set-up and barring normal judicial course in the same Act (Clause 19) have not gone down well with the farmers and need reconsideration. There is visible fear among the peasantry that CF may lead to greater direct entry by corporate entities in agriculture and that would result in dispossession of their land. It is important to dispel this fear for spurring this potentially transformational system of farming.

The author is former VC, Maharana Pratap University of Agriculture and Technology, Udaipur

Send your feedback to letters@tribunemail.com