TH GST Rates —click to open pdf file

‘One nation, one tax’ regime gets rolling

At midnight session, Prez calls GST ‘disruptive change’; PM says it’s collective achievement

An illuminated Parliament House in New Delhi on Friday night during the midnight rollout of the Goods and Services Tax in the Central Hall. Photo: Mukesh Aggarwal

Sanjeev Sharma

Tribune News Service

New Delhi, June 30

India’s biggest tax reform since Independence Goods and Service Tax (GST) was launched at a special session in Parliament’s Central Hall at the stroke of midnight.The GST, countrywide single taxation system which has been in the making for 15 years, was launched by President Pranab Mukherjee and Prime Minister Narendra Modi by pressing a button in an hour-long special function in Parliament attended by MPs, state finance ministers, GST Council members and other dignitaries.Among those present on the dais along with the President and Prime Minister were Vice President Hamid Ansari, Lok Sabha Speaker Sumitra Mahajan, Finance Minister Arun Jaitley and former Prime Minister HD Deve Gowda. Former Prime Minister Manmohan Singh skipped the event as the Congress had decided not to attend the function.(Follow The Tribune on Facebook; and Twitter @thetribunechd)The GST seeks to create a national market for goods and services by subsuming multiple taxes at the national and state level, thereby creating a paradigm of “one nation, one tax, one market”.President Mukherjee said GST was a “disruptive change” and similar to the introduction of VAT when there was initial resistance. “When a change of this magnitude is undertaken, however positive it may be, there are bound to be some teething troubles and difficulties in the initial stages,” he said.Video courtesy: Facebook handle of PIB

Modi called the GST “Good and Simple Tax” which would replace 500 kinds of different taxes prevalent in the country. Showering praise and thanking political parties, Modi said the GST was the result of combined efforts of all political parties and did not belong to any one party or one government.Invoking the legacy of Sardar Patel, the Prime Minister said the GST would bring about economic integration of India similar to what was done by Patel at the time of Independence to integrate the states and the country.Referring to the vision of New India, Modi said the GST was the economic system of a New India and its scope was not limited to the financial system but now India would move in a new direction.The PM said under the new system due to an audit trail, the harassment of traders and small businesses will end while integrating India into one market with one tax rate.During the initial phase, he said that doubts and anxiety should not be spread and even small traders will adapt to the new system. He added that GST will end generation of black money and corruption, promote new governance culture and help to garner resources for the welfare of the poor.Talking about the teething troubles, the PM said even eyes had to adjust for some days when once wears new spectacles. In his address, Mukherjee said the central tax was a “tribute” to the maturity and wisdom of India’s democracy, as he recalled steps taken during his own tenure as Finance Minister on this key reform measure.“The new era in taxation is the result of a broad consensus arrived at between the Centre and states. This consensus took not only time but also effort to build. The effort came from persons across the political spectrum who set aside narrow partisan considerations and put the nation’s interests first. It is a tribute to the maturity and wisdom of India’s democracy,” Mukherjee said.He said the GST Council should continuously review the implementation and suggest improvements to the taxation regime. After the GST launch, the government imposed levy of 10 per cent basic customs duty on mobile phones, which make imported phones expensive, while inputs and raw materials for manufacture are exempt.Momentous event: PranabIt is a momentous event for the nation. This historic moment is the culmination of a 14-year-long journey which began in Dec 2002. It (GST) is a tribute to the maturity and wisdom of India’s democracy. It will make exports more competitive and provide a level playing field to domestic industry. —Pranab Mukherjee, PresidentGood and Simple Tax: MODIIt’s the best example of cooperative federalism and success of Indian democracy. GST is ‘Good and Simple Tax’ — good because there will be no tax on tax and simple because there will be only one form of tax. It will help eliminate black money and corruption. —Narendra Modi, Prime Minister

Highlights

GST is a tribute to the maturity and wisdom of India’s democracy: Pranab

This historic moment is the culmination of a fourteen-year long journey which began in December 2002: President

Introduction of GST is a momentous event for the nation: President Pranab Mukherjee

It is good and simple tax: PM Modi

Not just economic reform but also social reform

Working with vision of new India by 2022: PM Modi

Foreign investors will get a good opportunity in india

GST is not the legacy of one political party but the collective legacy of all political parties: Modi

GST is economic integration

One nation one tax to replace 500 kinds of taxes

Central Hall is the most appropriate venue for historic GST launch, says PM

Central Hall of Parliament witness to momentous occasions of Indian history

It is the contribution of every party and government

The path we have chosen doesn’t belong to one government or one party

GST process big example of cooperative federalism

125 crore Indians will be witness

India will move in a new direction

PM says at midnight we will steer country direction

Prime Minister Narendra modi starts addressing at GST function

Will boost revenues drive growth and single flow of goods and services

GST has removed multiplicity of taxes and cut tax interface: FM

Jaitley says India will write new destiny and GST being launched in time of global slowdown

GST process started 15 years ago, says FM

Thanks Mps political parties state Finance Ministers

New India will create one tax, one nation, one market, says Finance Minister Arun Jaitley

President Pranab Mukherjee, PM Narendra Modi, VP Hamid Ansari arrive in Central Hall of Parliament for the launch of GST.

Former Prime Minister H D Deve Gowda on dais with President, PM, Vice President and Lok Sabha.

Former PM Manmohan Singh skips GST launch event owing to Congress’ boycott of the ceremony. (With PTI inputs)

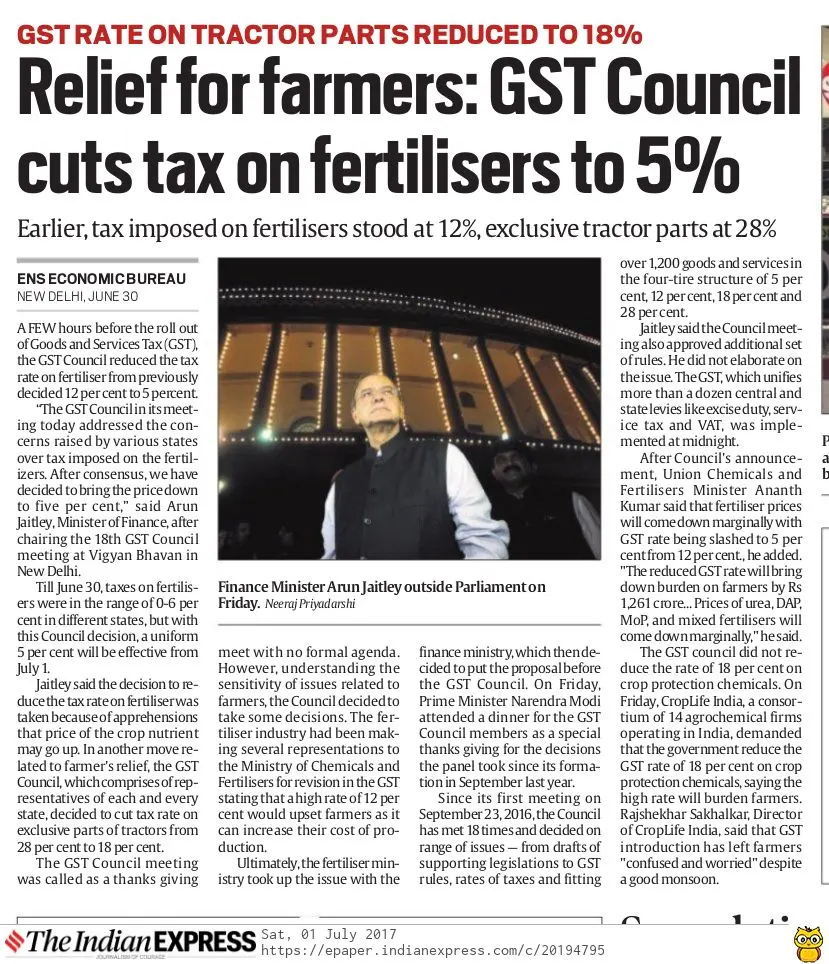

Fertiliser rate cut from 12% to 5%

In a farmer friendly move, the GST Council chaired by Finance Minister Arun Jaitley decided that the GST rate on fertilisers will be reduced from 12 per cent to 5 per cent and on exclusive parts of tractors from 28 per cent to 18 per cent. The reduction of tax on fertiliser will benefit farmers to the extent of Rs 1,261 crore. TNS

AT MIDNIGHT, MODI RINGS IN INDIA’S ‘GOOD & SIMPLE TAX’

Govt ushers in an ambitious taxation regime that promises to be a gamechanger for the Indian economy

Pressing a button at the stroke of midnight on Friday, President Pranab Mukherjee and Prime Minister Narendra Modi launched India’s biggest tax reform from the historic central hall of Parliament, cheered on by some of the country’s top names in politics, business and law.

GST is not the legacy of one political party but the collective legacy of all political parties NARENDRA MODI, Prime Minister

It was a luxury welcome for the long-awaited Goods and Services Tax (GST), ending a 14-year struggle to enlist political support for a move that will replace some 20 federal and state levies and unify a country of 1.3 billion people into one of the world’s biggest common markets.

The event condensed years of anticipation, frustration and hope into a moment of celebration. A festive air permeated a brightly illuminated, flower-bedecked parliament building. A short film on the GST played out on television screens as soon as Modi and Mukherjee pressed a button.

About 1,000 people packed the hall when Modi began to speak from where India declared itself a free nation and first Prime Minister Jawaharlal Nehru made his famous “tryst with destiny” midnight speech almost 70 years ago.

Modi referred to the central hall’s illustrious history, saying there could be no place more pious to launch what will be a crucial cog in India’s gearwheel of growth.

“From Leh to Lakshadweep, India will now have one tax. GST is actually a Good and Simple Tax,” he said as the audience thumped their desk in approval.Both Modi and finance minister Arun Jaitley struck a note of political conciliation as they shared credit for the rollout of the GST with all political parties and past governments.

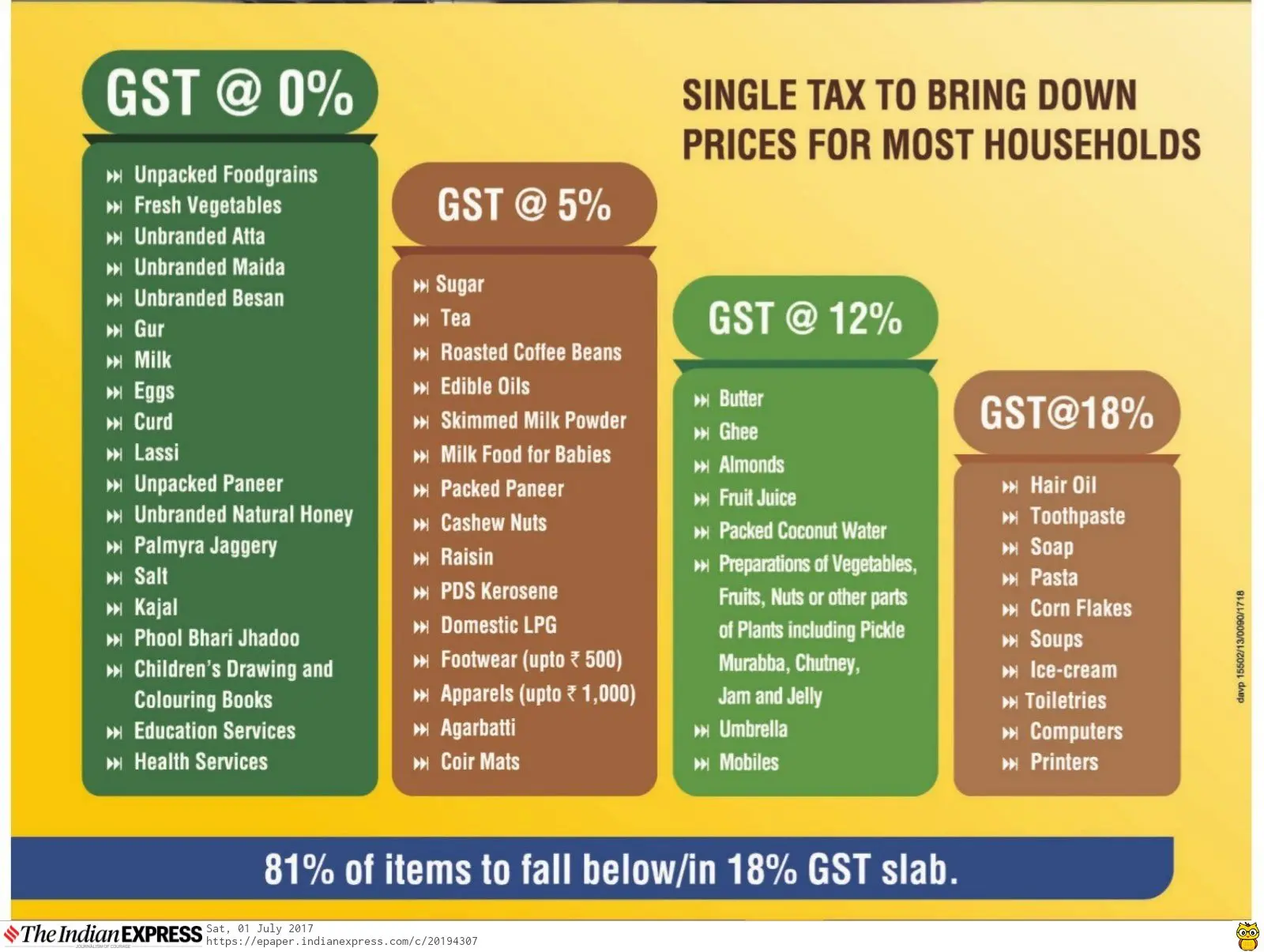

What’s up, what’s down: Decoding effect of GST on daily life

Business houses should pass on the benefits of GST to customers. If they do not do that, they will be hit by the antiprofiteering clause. AJAY JAGGA, advocate and member of CPC,Chandigarh

Goods and Services Tax (GST) coming into effect, HT decodes the effect of new regime on the rates of various items used in our day-to-day life. While most of the goods are getting cheaper, services and luxury products will become expensive.

Food grains will become cheap as the government has exempted these items from GST purview. But branded foodgrains and pulses come under 5% tax slab.

In the case of mobile phones, imported phones will become cheap, but locally manufactured ones will get costlier.

City-based lawyer, Ajay Jagga said, “On imported mobile phones, there was 21.85% tax, which included import duty (12.5%) and VAT (9.35%). The government has imposed 12% GST, which makes imported phones cheap.”

WHAT WILL BECOME CHEAPER AND WHAT WILL COST MORE?

There will be 18% tax on hair oil, soaps and toothpaste, making these items cheaper. Before GST, around 25% tax was imposed on these items.

However, one will have to shell extra money for buying shampoo, liquid soaps, shaving creams and other toileteries as these items will be taxed at 28%, costing around 3% more.

COFFEE LOVERS CAN REJOICE

Several food items such as edible oil, tea, coffee, sugar, spices have been kept at 5%, with exemption for fresh milk and foodgrains. Tax on coffee will come down from 12 % VAT to 5% GST.

Similarly, sugar will become cheap as tax will come down from 12.5% to 5%.

SHELL 3% EXTRA ON ELECTRONICS

With 28% tax under GST, electronic items such as televisions, refrigerators, air conditioners and washing machines may get costlier from July 1. Currently, these items are being taxed at 25%.

STAYING AT HOTELS, AC DINING TO COST LESS

Staying at hotels and AC dining will become cheap. Earlier, one used to pay over 18.5% tax on AC dining, but now it has come down to 0.5%.

TAXI RIDES, NON-AC RAILWAY, ECONOMY CLASS FLIGHT CHEAPER

From today onwards, taking taxi rides will become more affordable as tax will be reduced from 6% to 5%. There is a reason to cheer for people travelling in non-AC railways as there is no tax rate on it. Air-fare for economy class will become cheaper, as the tax will be reduced by 1%.

However, those travelling in AC coach will have to pay more than the double of the tax, as it will be increased from 5% to 12%. Similarly, airfare for business class would become expensive. The tax will be increased form 9% to 12%.

“Entertainment duty will be brought down from 30% to 28% under GST, hence watching movies in cinemas will become cheap,” said Jagga.

People will have to shell 1% extra tax for buying gold jewellery,” Jagga said.