Ruled out a roll back. PTI file photo

Govt rejects rollback as Opposition guns for PM

PARLIAMENT DEADLOCKED Row rages as Centre tweaks cash rules yet again

NEW DELHI: Opposition parties paralysed Parliament on Thursday, demanding Prime Minister Narendra Modi’s presence during a debate on the government’s shock decision to recall `500 and `1,000 banknotes that has caused hardship to the people.

The government rejected the demand, citing its prerogative to decide who should reply to the debate and ruled out any rollback of the decision to scrap high-value notes.

The political blame game took an unpleasant turn in the Rajya Sabha as it deviated from demonetisation to patriotism and Pakistan.

It was triggered by a controversial remark by leader of the Opposition, Ghulam Nabi Azad, over the death of 40 people in long queues outside banks and ATMs, a comment expunged later.

Backed by angry ruling party MPs, information and broadcasting minister Venkaiah Naidu termed Azad’s statement “atrocious, objectionable and anti-national” and demanded an apology from him and the Congress party. “Pakistan-sponsored terrorism has taken the lives of thousands of people… you are comparing this (deaths of people outside banks) with Pakistani terror. Pakistan will use this statement,” said the minister. An unrelenting Azad said that people like him in Kashmir—he hails from the Valley— are dying in Pakistani firing. “You are the supporter of Pakistan. You participate in their feast. You send them shawls, mangoes… You go to their marriage ceremonies uninvited…,” said the Congress leader, in an apparent reference to Modi’s unscheduled visit to Lahore last Christmas to meet Pakistani premier Nawaz Sharif amid preparations for his granddaughter’s marriage.

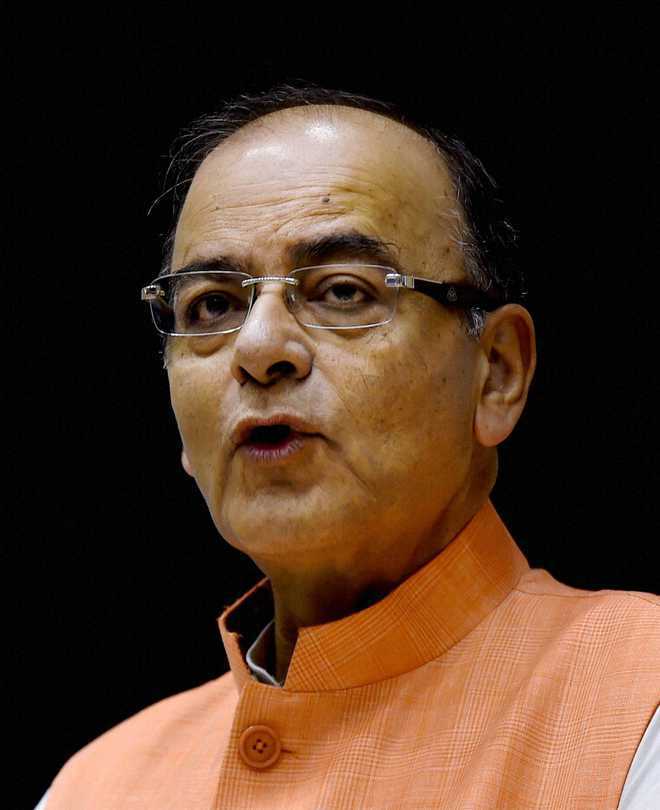

Finance minister Arun Jaitley later slammed the opposition party for its “irresponsible” behaviour in Parliament.

“The Congress is a political party which has remained in power. What selfish motive does it have to weaken this move of the government? We would have expected the Congress to support it. This is not patriotism that you connect this with terrorism. Even the terrorists use black money,” Jaitley told ANI. “If the government thinks it necessary at an appropriate time for the Prime Minister to intervene, we will consider it at that stage. But it’s not necessary that there is an intervention in every debate.” The opposition also took the political battle outside Parliament, with West Bengal chief minister Mamata Banerjee and her Delhi counterpart Arvind Kejriwal leading a rally in Delhi. They also set a three-day deadline to the Centre for withdrawing the demonetisation move.

Petrol pumps to dispense cash

22,500 ATMs will be recalibrated today (Thursday) to allow withdrawal of `100, `500 and `2,000 notes… ARUN JAITLEY, Union finance minister

NEW DELHI: Select petrol pumps across the country will begin giving out banknotes to the public by letting them swipe their debit cards, the latest in a series of announcements (see box) made on Thursday to ease the cash crunch brought on by a ban on high-value currency last week.

OLIVER FREDRICK/HTAn elderly woman, whose son had been diagnosed with cancer, was handed a bag containing `1 coins against `2,000, which she went to exchange at a bank in Uttar Pradesh’s Mohanlalganj.

According to the oil ministry, 2,500 outlets of Indian Oil, Bharat Petroleum and Hindustan Petroleum with State Bank of India card-swipe machines will offer the cash service. The facility may be expanded to 20,000 stations. “The process will begin tomorrow… and will continue till the cash availability improves,” an oil ministry source said.

Earlier, the government indicated efforts were being stepped up to make ATM machines across India compatible with new `500 and 2,000 banknotes, and new rules that will let banks give more people cash by tightening the limit on how much old currency an individual can exchange.

“Some 22,500 ATMs will be recalibrated today to allow withdrawal of `100, `500 and the `2,000 notes. Nearly 200,000 ATMs exist as of now,” finance minister Arun Jaitley said. Since the recalibrations began on November 12, about 40,000 — or a little over 18% — of India’s ATMs have been configured to dispense the new notes, sources told HT. This has led people to queue up for hours at ATM machines and banks, where scuffles and even deaths have been reported.

Resetting ATMs (automatic teller machines) takes three to four hours, according to an official at a private firm that maintains the machines for banks. If the new target resetting 16,000 ATMs a day is met, it will take two weeks to recalibrate ATMs across the country.

A task force under Reserve Bank of India (RBI) deputy governor SS Mundra was set up on Monday to monitor the recalibration exercise. The task force has decided to segregate machines based on their location. ATMs near hospitals will be accorded “priority status”. “We are closely monitoring the recalibration exercise and things should settle down in the next few weeks. The task force is also reviewing the situation on a daily basis,” Rituraj Sinha, president, Cash Logistics Association and a member of the task force, told HT.

Now, exchange old notes at airport

Tribune News Service

Chandigarh, November 17

Now, you can exchange your junked Rs 500 and Rs 1,000 notes at the international airport in Mohali from tomorrow onwards.Disclosing this here today, airport CEO Suneel Dutt said following a decision taken by the Airports Authority of India (AAI) to allow any scheduled commercial bank to open and operate (on a temporary basis) currency exchange counter (small) without levying charges for space and electricity at its airports across the country up to December 31, subject to the availability of space, the State Bank of India (SBI) today established a counter at the arrivals area to exchange the now-defunct currency notes from 11 am onwards tomorrow.

SBI GM (Network 1) Sanjay Kumar said the initiative was taken to help inbound tourists and foreign travellers, besides other passengers for getting valid Indian currency on arrival. The airport CEO assured every possible support to the SBI for smooth functioning of the services for the benefit of the passengers.?

Cashless, farming sector stares at rough rabi season

Experts say govt relief for farmers a ‘in the ocean’

A farmer counts her money before depositing it in a bank. File

Vibha Sharma

Tribune News Service

New Delhi, November 17

Ten days after Prime Minister Narendra Modi’s demonetisation move in the peak of the rabi sowing season, the government today announced relaxations for the critical farming sector. However, agriculture experts term these as a “drop in the ocean” given the plethora of problems the deep-distressed agriculture sector is already facing.Fearing a negative effect on coverage, productivity and quality of rabi crops, they apprehend offsetting of gains made by the farming sector due to a good monsoon season this year after two years of consecutive drought.The government has allowed farmers, who have taken crop loan or have kisan credit card, to withdraw Rs 25,000 per week. Experts, however, say the question is not about the withdrawal of money but the cash lying with farmers from sale of kharif produce, which they would have otherwise used for buying seeds and fertilizers and paying the farm labourers in the ongoing rabi season.As per the relaxations, those who have got payments through RTGS or cheque deposit in KYC-compliant bank account can withdraw additional Rs 25,000 a week. This takes the total cash withdrawal limit for farmers from KYC-compliant bank accounts to Rs 50,000 per week.Agriculture expert Ajay Jhakkhar terms these as “good steps” but says the money also needs to be physically available with banks for farmers to withdraw. “It is not the question of limits or a certain amount, it can be Rs 10,000 or Rs 25,000, but the physical availability of that amount at a bank counter when farmers reach there. Maximum brunt will be borne by farmers in Punjab and Haryana who largely operate through primary agriculture societies and cooperative banks,” he says.Lucknow-based expert Sudhir Panwar says there are many dimensions to the issue and the move may affect the sector in more than one ways. For one, it may affect the rabi sowing and production of winter crops such as wheat, gram and mustard.“The proceeds from the just-concluded kharif season (paddy and pulses) were mostly in cash (Rs 500 and Rs 1,000 currency) which suddenly became unusable at the peak of the rabi sowing season. Rural branches do not have adequate cash. As a result, both farmers and farm labourers are now standing in queues at a time they would have been busy in fields”.Also farmers sow a percentage of new seeds every season. Those who do not have adequate money for seed replacement will be forced to use grain from the last year’s crop. “This will affect the SRR — the seed replacement ratio — which should ideally be 20 per cent to increase yield and vigour of the new crop,” says Panwar.Experts fear keeping in mind the dismal banking infrastructure and their huge dependence on cash, farmers may have to bear the impact much longer.

Punjab, Haryana may bear the brunt

- Punjab and Haryana farmers are likely to bear the brunt of the demonetisation move as they largely operate through primary agriculture societies and cooperative banks. Money needs to be physically available with banks for them to withdraw

- The move is likely to affect the rabi sowing and production of winter crops such as wheat, gram and mustard. At a time when farmers and farm labourers should have been busy in fields, they are lining up in banks to withdraw/change cash

- Also, those with inadequate cash would be forced to use grain from last year’s crop, thus affecting the seed replacement ratio (SRR), which is ideally 20 pc to increase yield and vigour of the new crop, feel experts

Production likely to dip: Expert

- “The rabi sowing window is open for only 20 to 25 days. November is the peak time when farmers are running around to arrange cash for seeds, fertilisers and labour. The move has increased hardships of farmers, which is bound to affect the production next year” Sudhir Panwar, farm expert

Relief for farmers, traders, to-be-wed

The inconvenience to the public. PTI

- Withdraw up to Rs 2.5 lakh for weddings

- Farmers can take out up to Rs 50,000

- Exchange of defunct notes halved to Rs 2,000

- Toll exemption on NHs now till Nov 24

- Select petrol stations to give up to Rs 2,000

Tribune News Service

New Delhi, November 17

To help farmers, agricultural traders and those getting married, the government today reduced the limit of over-the-counter exchange of old notes to Rs 2,000 per person. It gave an option to Central Government employees up to Group C to draw an advance of Rs 10,000 from their November salaries.The government has allowed cash dispensation up to Rs 2,000 through debit/credit card swipe using point-of-sale (POS) machine at select petrol stations.For the explicit purpose of marriage, withdrawals up to Rs 2.5 lakh from bank accounts have been allowed.(Follow The Tribune on Facebook; and Twitter @thetribunechd)Economic Affairs Secretary Shaktikanta Das today announced that up to Rs 2.5 lakh could be drawn from one of the bank accounts, either that of the bride, the groom or immediate kin.Das said the weekly withdrawal limit for Agriculture Produce Market Committee (APMC) traders had been relaxed to Rs 50,000. Also, farmers could draw up to Rs 25,000 per week in cash from their KYC-compliant accounts. They could draw Rs 25,000 per week against loans sanctioned or kisan credit cards. Reports suggest that from tomorrow, banks would cater to 60 outside customers and concentrate more on those having accounts with their branch.PTI adds: Quoting of PAN for cash deposits aggregating Rs 2.5 lakh or more in bank accounts is mandatory. Quoting PAN is mandatory for cash deposit of over Rs 50,000 in a single day in scheduled or a cooperative bank. The additional requirement has been made mandatory to avoid ill-gotten wealth being converted into white.

No takers for coins he got in exchange from bank

Sanjay, along with his mother, shows the Rs 10 coins. Photo: Inderjieet Verma

Mohit Khanna

Tribune News Service

Ludhiana, November 17

Fear of counterfeit coins of Rs 10 denomination being in circulation has increased the suffering of the common man who is already grappling with the situation triggered by the scrapping of Rs 500 and Rs 1,000 notes by the government.Sanjay, a resident of Kakowal Road, who had received Rs 10 coins in exchange for Rs 1,000 in banned currency, has landed in yet another problem. He has been unable to buy ration since yesterday as no one is accepting Rs 10 coins for the fear of these being fake.“I went to a grocer but he refused to accept the coins, saying that these were fake. I told him that I have got the money from Canara Bank, Chaura Bazar, but he still refused to accept the money. From milkman to bread-seller, no one is accepting these coins. There are widespread rumours of the Reserve Bank having banned the Rs 10 coin,” said Sanjay.Sanjay today visited the BJP party office near Clock Tower to seek their help to exchange the coins. “I could not meet anyone there today but I will visit here again tomorrow,” said Sanjay, a vendor, who is the sole breadwinner of a family of five.“There has been a serious scarcity of money ever since the government banned Rs 500 and Rs 1,000 notes. My old parents, my wife and child, all are dependent on me. After real hardship, I got the coins in exchange but these are not being accepted in the market,” said Sanjay while showing the coins.He said demonitisation had broken the back of daily wage earners.“I am not against the demonetisation move. But I am against its poor implementation. People are really struggling to get cash. It has been eight days since the announcement was made and there has been no respite,” said Sanjay.Sanjay said travelling by bus and other modes of public transport with coins in the pocket has become a a risky proposition.“Yesterday, a conductor of the city bus declined to accept Rs 10 coins and entered into an argument with my father. The conductor even scuffled with his father and tore his shirt. We can’t board auto-rickshaws and had to walk down to reach home or markets,” said Sanjay, while showing the coins along with his mother.No vegetable vendor was accepting the Rs 10 coins, said Kamlesh, Sanjay’s mother.City Bus service conductors will accept Rs 10 coins: GM“The scuffle with a passenger over Rs 10 coins was unfortunate. We will look into the issue and take action against the erring conductor if found guilty. It is our appeal to passengers that we are accepting Rs 10 coins. Yes, there are rumours that counterfeit Rs 10 coins are in circulation. We have written to banks and met senior officials over this issue. Today, the bank officials said they had not received any instruction from the authorities on banning the Rs 10 coin,” said Baljit, General Manager, City Bus Service.

After Kashmir unrest, note ban further hits Punjab hosiery sector

GONE COLD Some units stop production to tide over cash crunch to pay workers; no new orders

There are only a few brands that have bank accounts of workers; the rest are medium and small units. Traders came to us during weekends and paid in cash. We are not sure if we should accept the old currency. The ban has left us with no cash to pay the labour VINOD THAPAR, chairman of Knitwear Club, Ludhiana EARLIER THIS YEAR, DISTURBANCE IN PRIME MARKET KASHMIR HIT ORDERS; NOW INDUSTRY IS REELING UNDER DEMONETISATION OF `500 & `1,000 NOTES

CHANDIGARH: It was chill of a different kind that the hosiery and blanket industry of Punjab was hoping for this winter. Sales in last two years had not been brisk owing to warmer winters. The only consolation was the Kashmir valley, which has a longer winter spell and good tourist footfall.

But Punjab’s winter-dependent industry suffered a major blow this year after months of unrest in Kashmir, following the killing of militant Burhan Wani. Now, the industry is reeling under the aftershocks of demonetisation of `500 and `1,000 notes. Some units in Punjab’s industrial hub, Ludhiana—which has nearly 15,000 big, medium and small hosiery and knitwear units making shawls, sweaters, jackets, gloves, caps and warmers—have cut down production or stopped it altogether owing to cash crunch. So, are the 200-odd blanket manufacturers in Amritsar.

“Our industry has suffered the most this year. Jammu and Kashmir is our biggest market for hosiery products as it has long winters and huge inflow of tourists and pilgrims at Vaishno Devi. But all orders from the Valley this year got cancelled. Our business in other parts of the country is seasonal and we are able to earn only in the winter months. There are only a handful brands that have bank accounts of workers, rest are medium and small units. Most traders from J&K, Himachal, Punjab, Haryana and Delhi came to us during weekends and made payments in cash. We are not sure if we should accept the old currency. The note ban has left us with no cash to pay the labour,” said Vinod Thapar, chairman of Knitwear Club, Ludhiana.

Gurdit Singh, owner, Oster Woollen Mills, Ludhiana, said they stopped the production last week. “The hosiery industry was already hit by relatively warmer winters in the last two years. The return of unsold stock from wholesalers and retailers was also high. This year, we hardly got any orders from Kashmir due to the unrest. After the note ban, there is no fresh demand from retailers and wholesalers, who in turn say there are fewer customers. There is no point in producing when there is no demand,” he said.

Owners of blanket units in Amritsar say traders from Bihar, Uttar Pradesh, Madhya Pradesh and Bengal are cancelling orders. “We supply tweed for Kashmiri ‘phiran’. But this year, we were not able to get orders from the Valley as the tourist inflow was hit. Wholesalers and retailers order stocks and it takes 20 days to reach states such as Bihar, Bengal and Madhya Pradesh. After scrapping of old notes, they are calling us to say they do not want the stocks. This season is a total washout for us. We will suffer losses to the tune of crores,” says Sudershan Wadhwa, general secretary of Shastri Market Association in Amritsar, an umbrella body for textile units in the city.

The ripple effect is also being felt by spinning mills, wholesalers and retailers. But the worst affected, say the manufacturers, are labourers from UP and Bihar. “The textile industry is country’s second biggest employer after agriculture. Nearly 99% of our workers are migrants from UP and Bihar. Since some units have stopped production, labourers are feeling insecure and it may worsen the problem as we fear mass migration. Since units are not able to pay the labour in cash, the workers are queuing up outside banks to withdraw cash and not reporting at work,” says Thapar.

But Ashok Jain, who owns Mini King Fashion, welcomed the government’s move. “Our production is 80% of the normal. But once the currency crunch ends, even old stocks will get cleared,” he said. Ajit Lakra, president of Ludhiana knitwear and textile industry, feels demonetisation will lead to some course correction by the industry. “Textile units have started opening accounts of workers. The loss is short-term and sales may pick up eventually,” he said.

Currency claims more lives

DEMONETISATION WOES Bank manager in Haryana dies of heart attack after spending three nights at work, another man also suffers cardiac arrest ahead of daughter’s wedding

Due to the increased work-load, Kumar had been sleeping in his office from the last three days. His family said that he was on medication for heart disease. NEERAJ KUMAR, police station in-charge

From page 01 ROHTAK: A 56-year-old bank manager in Haryana died of a heart attack after spending three days serving hundreds of customers following the government’s shock withdrawal of high-value currency notes of `500 and `1,000.

Police said that Rajesh Kumar, manager of Rohtak’s Cooperative Bank, was found dead in his chamber on Wednesday morning after spending three nights in the office because of the increased work-load.

Banks across India have struggled since `500 and `1,000 notes were recalled last week as millions have poured in to exchange or deposit old currency.

Banks have been asked to open early or close late to accommodate the large crowds, adding to the woes of the bank staff.

“Due to the increased workload, Kumar had been sleeping in his office from the last three days. His family said that he was on medication for heart disease,” said Neeraj Kumar, Shivaji colony police station in-charge. Work at the bank has been suspended.

When a security guard reached the bank on Wednesday morning, he knocked at the manager’s office door but got no reply. He alerted other bank employees and called in the police, who broke the door to find Kumar dead.

The police said that Kumar belonged to Gurgaon and is survived by his wife and two children.

Earlier this week, a man in Punjab’s Tarn Taran had died of heart attack reportedly after not being able to arrange cash for his daughter’s wedding.

RSS on tenterhooks after govt’s demonetisation move

CAUTIOUS Sangh tight-lipped about impact on forthcoming polls, asks BJP to guard against crime rise, possibility of breach in law and order

NEW DELHI: It may have welcomed the Centre’s decision to wage a war against black money by demonetising currency of `500 and `1,000 denomination, but the distress caused to people, especially in rural and semi-urban areas, has not gone unnoticed by the Rashtriya Swayamsevak Sangh (RSS).

PTI PHOTOSamajwadi Party workers block railway tracks by burning an effigy of PM Narendra Modi in Allahabad on Thursday.

The political mentor of the BJP is learnt to have conveyed to the party the problems in dispersal of new currency.

While the cadre has reported widespread distress among people queuing up to get their old currency exchanged, the Sangh brass is also gearing up to placate the small and medium traders who have been its support base.

According to sources in the Sangh, while a larger section is happy about the surgical strike against black money, Prime Minister Narendra Modi’s statements perceived to paint the rich as black money hoarders have not been well received.

“There is a danger is generalising. Not all those who have made money are cheats or black money hoarders. It has upset some people,” said a source.

He said the comment was comparable to the PM’s earlier stand on a majority of the cow vigilantes being criminals.

The Sangh is tight-lipped about the impact of demonetisation on the forthcoming state assembly polls in Uttar Pradesh, Punjab and three other states, but admits the move can have an adverse effect. “The wedding season is on and there are people who are facing hardships,” the source said.

The Sangh, however, has thrown its weight behind the government that has ruled out a rollback.

Deputy Prachar Pramukh (media in-charge) J Nandakumar in a tweet said those seeking a rollback of the policy are the “Same Award Wapasi gang, same Afzal Guru supporters and Break India brigade”.

Following feedback from the ground, the BJP has also been sounded off in an informal interaction to guard against rise in crime and the possibility of a breach in law and order.

“In some areas, where people do not use banking facilities, the chances of law and order being disrupted are high. We hope the government will take into account these issues,” said a Sangh functionary.

Officials take `4L bribe in new notes, arrested

THE KANDLA PORT TRUST OFFICIALS WERE HELD FOR ALLEGEDLY ACCEPTING A BRIBE OF `4 LAKH, ALL IN `2,000 NOTES

AHMEDABAD: Within days of the introduction of `2,000 currency notes, Anti Corruption Bureau (ACB) officials in Gujarat arrested two Kandla Port Trust officials in Kutch for allegedly accepting a bribe of `4 lakh — all in new `2,000 notes issued after the demonetisation of old `500 and `1,000 notes.

At the office of the complainant, the ACB laid a trap on Tuesday in which one Rudreshwar Sunamudi had come to collect the bribe amount allegedly on behalf of superintendent engineer (class-1) Shrinivasu and sub-divisional officer identified as Kumtekar. All three accused were arrested.

Where did a huge amount in new `2,000 currency notes come from is still being investigated. The government has fixed the withdrawal limit at `20,000 a week in the wake of the demonetisation decision.

The Narendra Modi government outlawed the higher denomination notes to slam brakes on corruption and unearth black money.

According to the police, Sunamudi played the middle man even as Shrinivasu was supposed to receive a sum of `2.5 lakh and `1.5 lakh was for Kumtekar.

A phone called made by the middleman through the complainant’s landline to one of the accused has also been recorded.

The complainant’s company is engaged in providing material supply to the KPT. And the bribe was demanded against a show cause notice by the KPT to the complainant’s firm for pending work.